Impact of Hyper Change on Financial Health and Continuity

Posted in News Story

By. A. Michael Gellman, CPA, CGMA

March 19, 2020

A. Michael Gellman is an independent Fiscal and Financial Strategist (CFSO) for nonprofit organizations and a founding principal partner for Fiscal Strategies 4 Nonprofits, LLC. He is also a part of the Center for Public & Nonprofit Leadership faculty.

During extraordinary times of hyper change, we are confronted with so many changing elements that making effective management decisions seems overwhelming and finding a starting point feels impossible.

For unprecedented periods like we are experiencing now, I firmly believe nonprofit organizations must take a conservative business approach to key decisions and make protecting financial assets and assessing financial impact on funding the number one priority to consider as part of each management decision. This is the appropriate approach at least until the future direction of a current extraneous driver, like a coronavirus, becomes clearer and real sustained recovery begins.

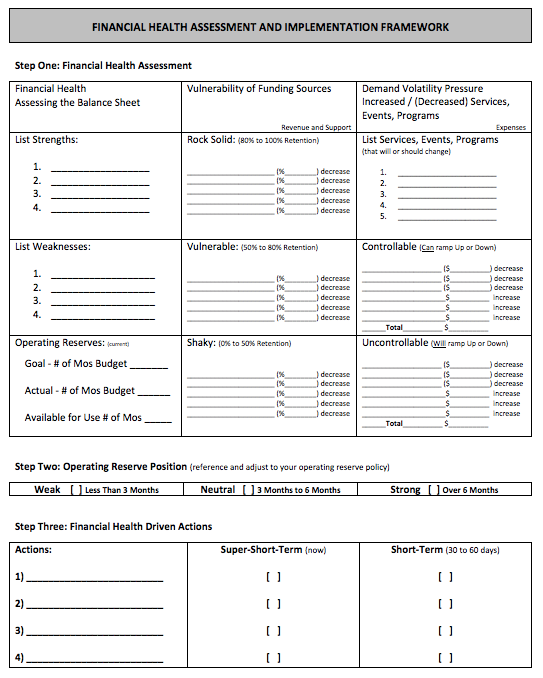

Focusing early decision-making on financial considerations helps provide a starting point for important actions that must be taken quickly. The good news is there is a framework for doing this that will allow an organization to assess its financial position, allowing the organization to react, respond and protect in a thoughtful manner during a period of volatile hyper change.

Three Critical Factors to Consider

There are three critical factors to consider and balance when assessing an organization’s current financial position and its impact on continuity:

- Financial health – assessing strengths and weaknesses

- Vulnerability of your funding sources

- Demand volatility pressure for increased and/or decreased services

The importance and prioritization of each critical factor will be different for every nonprofit organization and most likely will change as conditions during the hyper-change period evolve.

Focus on the Super-Short-Term

Another assessment metric to consider is the concept of “short-term vs. super-short-term”. Notice I do not even mention the terms intermediate-term and long-term. Because unpredictable actions out of our control are happening very quickly, you must currently focus your management decisions on the super-short-term to protect the financial health of your nonprofit organization. The concept of super-short-term focuses attention on management decisions that need immediate attention and action now over the next few days or weeks vs. other management decisions that can be deferred for 30 to 60 days from now that are not as time and resource allocation sensitive. For example, super-short-term decisions might focus on re-working a major annual event that is scheduled to start in three weeks, while short-term decisions might consider annual membership dues renewal scheduled to start in 90 days.

I believe that nonprofit organizations that move quickly to make definitive and targeted decisions will be in the best position to protect sustainability and survive. In contrast, nonprofit organizations that hesitate to change, will look back and regret their decisions to not have acted more quickly.

Organizations With and Without Operating Reserves

One final bifurcation to recognize is that financially healthy nonprofit organizations with sufficient operating reserves have a whole different set of options and tactics to consider than nonprofit organizations that are financially weak and unstable with limited to no operating reserves and low bank account balances. Even before the coronavirus pandemic occurred, a frighteningly high percentage of nonprofit organizations in the United States were underwater with negative operating reserves. Many of those organizations also had restricted net assets (gifts with donor restrictions), which were put at risk due to their weak financial position.

Simply put, nonprofit organizations that have excess operating reserves (more than what is stated in their operating reserve policy) have options to consider that nonprofit organizations that are underwater and financially weak do not. For the financially healthy nonprofit organizations the decisions are not easy, but if they make a wrong decision or do not act quickly enough, they will have suffered the consequences of burning through more liquid cash assets than they wished, forcing them to adopt more stringent strategies down the road. Financially weak nonprofit organizations will not have this luxury and will be forced to be in super-short-term decision-making mode now.

Financial Health Assessment Framework

I recommend completing the Financial Health Assessment and Implementation Framework, which will help you assess your organization’s current position and determine priority actions to take.

This assessment will give the board of directors confidence that the senior management team has taken a thoughtful and objective approach to quantify near-term financial decision making and implementation in this time of hyper change.

In the next set of financial management articles in this series, we will explore in more detail the financial assessment and financial strategies referred to above and compare and contrast how a weak financial position vs. a strong financial position will impact options available to a nonprofit organization.

You can contact Mr. Gellman at mgellman@fiscalstrategies4nonprofits.com.

Additional articles in this series, Leading in Times of Hyper Change, can be found on our website, Facebook and Twitter.

Current articles in the series include: